pay indiana estimated taxes online

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. INtax only remains available to file and pay the following tax obligations until July 8 2022.

Indiana Dept Of Revenue Inrevenue Twitter

INTAX only remains available to file and pay special tax obligations until July 8 2022.

. If you expect to have income during the tax year that. You will receive a confirmation number immediately after paying electronically via INTIME. Indiana Department of Revenue - DORpay.

Select the Make a Payment link under the Payments tile. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Increase in Gasoline License Tax and Special Fuel License Tax.

12-21-2021 Most Indiana Individual Income Tax Forms Now Online. 218-2017 requires the department to publish the new rates effective July 1 2022 for the gasoline license tax IC 6-6-11-201 and special fuel license tax IC 6-6-25-28 on the departments Internet website no later than June 1 2022For the period July 1 2022 to June 30 2023 the following rates shall be in effect. Find Indiana tax forms.

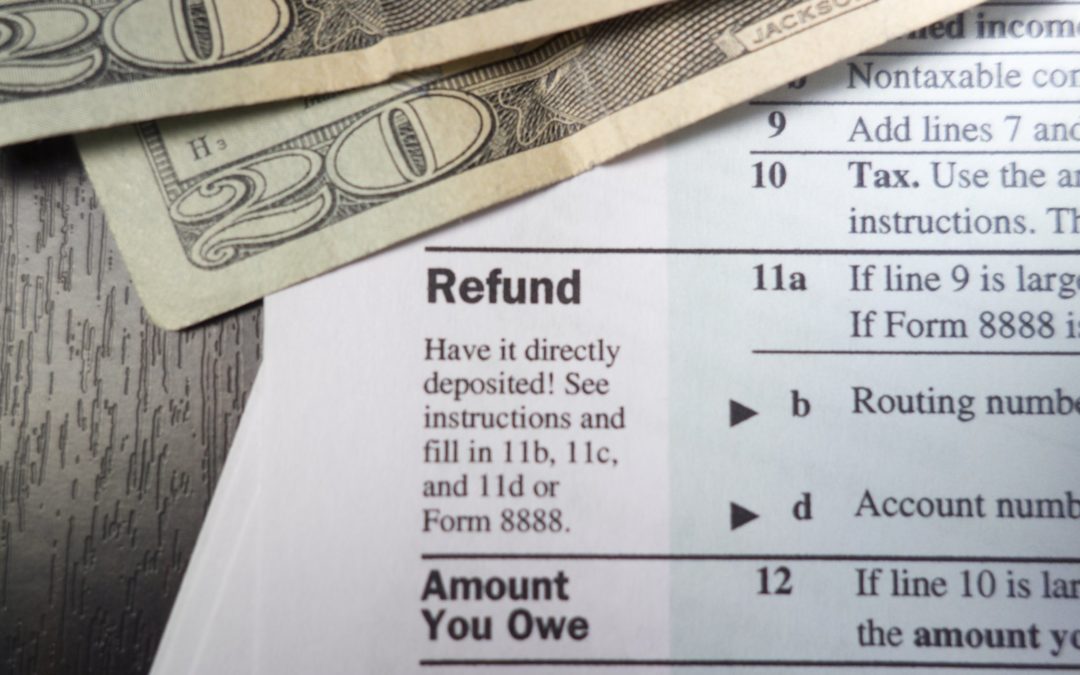

Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with a combined household income of 64000 or less. Know when I will receive my tax refund. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer.

These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July 18 2022. DORpay is a product of the Indiana Department of Revenue. The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income tax.

Taxpayers looking for services may dial 2-1-1 to find a nearby VITA location and schedule an. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Find more information on the modernization project.

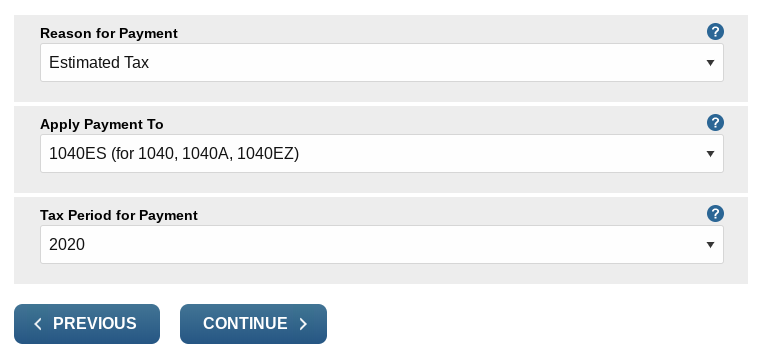

430 pm EST. To make an estimated tax payment online log on to wwwingovdor4340htm. To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option.

When you receive a tax bill you have several options. Take the renters deduction. Follow the links to select Payment type enter your information and make your payment.

Claim a gambling loss on my Indiana return. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am.

Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and You expect to owe more than 1000 when you file your tax return then you should pay estimated tax. Contact the Indiana Department of Revenue DOR for further explanation if you do. This option is to pay the estimated payments towards the next year tax balance due.

Pay my tax bill in installments. To make an individual estimated tax payment electronically without logging in to INTIME. For more information on DORs tax system modernization efforts visit Project NextDOR at doringovproject-nextdor.

Fields marked with are required. Have more time to file my taxes and I think I will owe the Department. Send in a payment by the due date with a check or money order.

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents Estimated Tax Payments Quarterly Taxes Tax Payment

Indiana Dept Of Revenue Inrevenue Twitter

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Installment Payment Agreement Template Lovely 14 Sample Payment Agreements Free Sample Example Payment Agreement How To Plan Business Plan Template Free

Quarterly Tax Calculator Calculate Estimated Taxes

Trade Services Interior Designer Trade Program Arhaus Arhaus Trading Tax Forms

If You Can T File Or Pay Taxes By Midnight April 15 Here S What To Do Tax Preparation Income Tax Tax Questions

Dor Owe State Taxes Here Are Your Payment Options

The Ultimate Guide To Paying Quarterly Taxes Everlance

Quarterly Tax Calculator Calculate Estimated Taxes

Dor Keep An Eye Out For Estimated Tax Payments

Apply My Tax Refund To Next Year S Taxes H R Block

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents Estimated Tax Payments Tax Payment Quarterly Taxes

Calculating Estimated Income Tax Payments With Variable Income Youtube